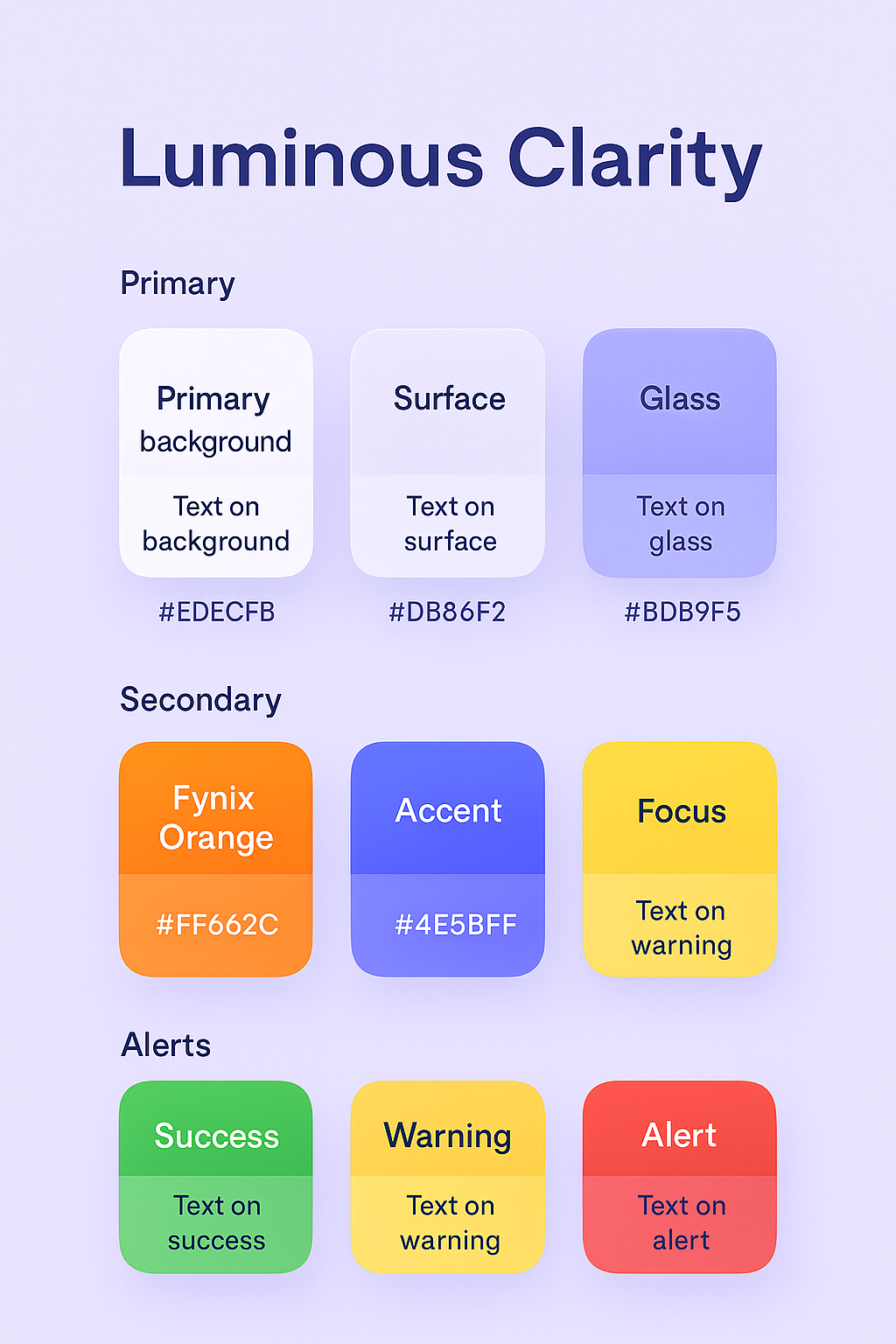

Lots of visual content, speed for product development exponential

While AI has exponentially improved speed and progress for product development, my hypothesis is that only emerging technologies and innovative patterns will come from human development